Many people call Colorado Springs home for multiple reasons whether it be the beautiful landscape, job opportunities, military transfers, or thriving business sector. It isn’t any wonder that U.S. News and World Report ranked Colorado Springs second in its “Best Places to Live” list. According to data from the U.S. Census Bureau, Colorado is the seventh fastest growing state in the country. If you’re interested in moving to Colorado, you’ll be pleasantly surprised to know that there are numerous local, state, and national down payment and mortgage assistance programs available to Colorado home buyers.

Many people feel they cannot afford to buy a home in Colorado Springs because they think they’ll need thousands for a 20% down payment or need an excellent credit score to apply for a home loan. However, these people are not aware of the first time home buyer Colorado grant programs available in every section of the state. Even current or previous homeowners can use some of these incentives.

This article explains why you don’t need perfect credit or a hefty 20% down payment to buy a home in Colorado. We’ll introduce you to the most popular Colorado first-time homebuyer loan programs and down payment assistance grants available in the state.

1. Colorado Housing and Finance Authority (CHFA) Programs

This program offers a 30-year, fixed rate mortgage that comes with either a 4% zero-interest second mortgage (silent second) or a 3% down payment grant. The silent second mortgage can help with closing costs and down payments. You must have a credit score of at least 620 and a minimum down payment of $1,000.

Another requirement is that you must take a homebuyer education course. You can find a schedule of upcoming courses here. In the course, you’ll learn the steps of the buying process which includes creating a budget, learning about your credit score, looking for a lender, and the steps of the loan process.

A few changes to CHFA have taken place since 2019. CHFA Advantage is no longer available, and income limits have been capped for the following CHFA programs:

- CHFA Preferred and CHFA Preferred Plus at 80 percent area median income (AMI)

- CHFA Preferred Very Low Income Program (VLIP) stays at 50 percent AMI.

- Check out this CHFA Income Chart for new conventional loan program income limits. All CHFA programs are listed on this chart along with the updated income limits for each one.

- CHFA DPA Grant is no longer available on CHFA Preferred VLIP and CHFA Preferred Plus.

- CHFA no longer allows manually underwritten conventional loans.

2. U.S. Department of Agriculture (USDA) Rural Development Loan Guarantee

First-time homebuyers and others can qualify for these loans as long as the home is in a designated rural area. The USDA home loan offers 100 percent financing, without a required down payment. This is a nationwide program (designated rural areas only) and usually requires a credit score of at least 640. Also, to be eligible, you must not have been previously suspended from other federal programs. Your real estate agent and lender can help you research whether or not the home’s location is in a designated rural area.

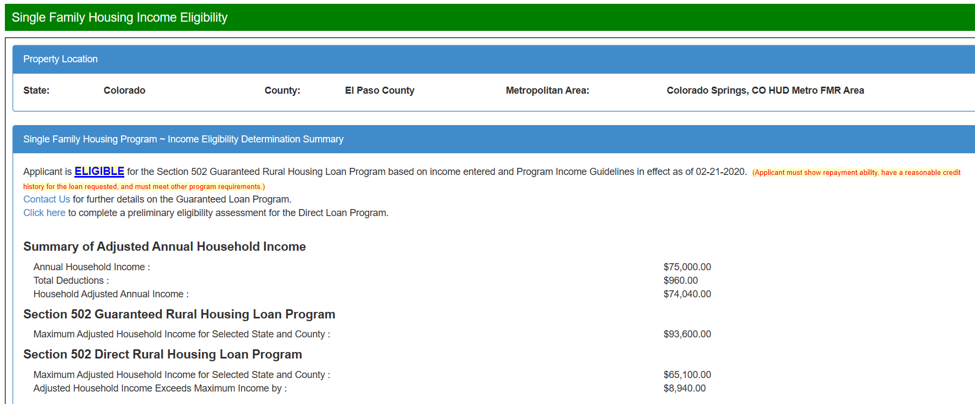

It’s easy to find out if you’re eligible for a USDA home loan. Go to the USDA’s Single Family Housing Income Eligibility page and fill in the information that applies to you and your family. Once you fill in this information along with your monthly income, you’ll see the result in a page that looks like this:

This shows the results for a family of four (2 adults with 2 children).

3. El Paso County Turnkey Mortgage Program

This county specific program offers a 30-year mortgage loan with a down payment grant of 3 percent to 4 percent of the total loan amount. No repayment is needed and there is no requirement for first-time homeownership. This down payment grant program is only available in El Paso County, including the city of Colorado Springs. To qualify, you must have a minimum credit score of 640. Loans for manufactured housing are not permitted and refinance loans are unavailable. Read more here.

El Paso County, Colorado offers a “Turnkey Plus” Mortgage Program which is a partially forgivable Down Payment Assistance (DPA) loan for homebuyers who purchase a home in El Paso County and the City of Colorado Springs. Homebuyers can receive up to a 4% or 5% soft second mortgage loan at 0% interest, deferred for 30 years. This Turnkey Plus program was rolled out on February 15, 2019.

Here are some details from the Turnkey Plus website:

Forgivable DPA Loan:

- 0% Interest

- 30-year deferred Second Mortgage

- 50% of the Second Mortgage Amount forgiven pro rata over the first five years (60 months) at 1/60th per month.

- Remaining 50% of the Second Mortgage Amount will be forgiven at the end of the 30-year period/maturity date of the first mortgage.

This program’s mortgage rates do change periodically and sometimes are above the market rate, so it’s a good idea to check with your lender first.

Here are eligibility details from the Turnkey Plus mortgage loan site:

Homebuyer Eligibility Criteria:

- Maximum qualifying income: $120,120 / $64,640 for Freddie Mac loan products

- Maximum home purchase price: None

- Maximum debt-to-income (DTI) ratio of 45% for Government loan products

- Maximum debt-to-income (DTI) ratio of 50% for Freddie Mac loan products

- Minimum 640 FICO score with 4% or 5% DPA loan

- FHA loan: FICO scores between 640-659 will receive a 3.5% or 4.5% DPA loan

Because this is not a “bond” program, there is no first time homebuyer requirement nor federal recapture tax under the El Paso County “Turnkey Plus” Program

4. Colorado Housing Assistance Corporation (CHAC) First-time Homebuyer Loan

This first-time homebuyer loan offers eligible buyers low-interest, flexible loan terms for a second mortgage to assist in down payment and closing costs statewide in Colorado. You must have a down payment of at least $1,000, or if in a disability program, $750. Your first lender must submit your application for CHAC assistance after you’ve completed a first-time homebuyer course. If you pay off the first mortgage, then your CHAC loan will be due in full.

5. VA Home Loan

This program is for first-time homebuyers and also for those who have already owned a home who are active duty military service members or veterans. The VA loan offers 100 percent financing without a down payment or the need for mortgage insurance. This is a nationwide loan program. Although the VA doesn’t set a minimum credit score requirement, most lenders require a minimum score between 600-620. This fantastic benefit can be used more than once and you can own more than one home at the same time. For more details, read about VA Home Loans here.

If you already have a VA loan, but would like to reduce your interest rates, consider an Interest Rate Reduction Refinance Loan (IRRRL) which is a “VA to VA loan.” This means it’s for service members who already have an existing VA guaranteed loan. The IRRRL helps to lower the interest rate and reduce the monthly payment. To learn more about the IRRRL loans, visit the eligibility section of the VA Loans website.

Still Thinking About Renting?

Once you’ve reviewed your home loan options, your dream of homeownership will get closer to becoming a reality. So many people don’t bother to research their options, such as a Colorado first time home buyer grant, and unfortunately, they spend years renting. Now that you know about these Colorado first time home buyer grant programs, you’ll be able to speak knowingly about them with a trustworthy lender. I work with a team of reputable and outstanding mortgage lenders that I can share with you when you’re ready to take the next step.

Remember, some banks will not share this information with you because they may not offer these financing options. It’s a good idea to ask your realtor to recommend local lenders who do offer these mortgage assistance programs and down payment grants.